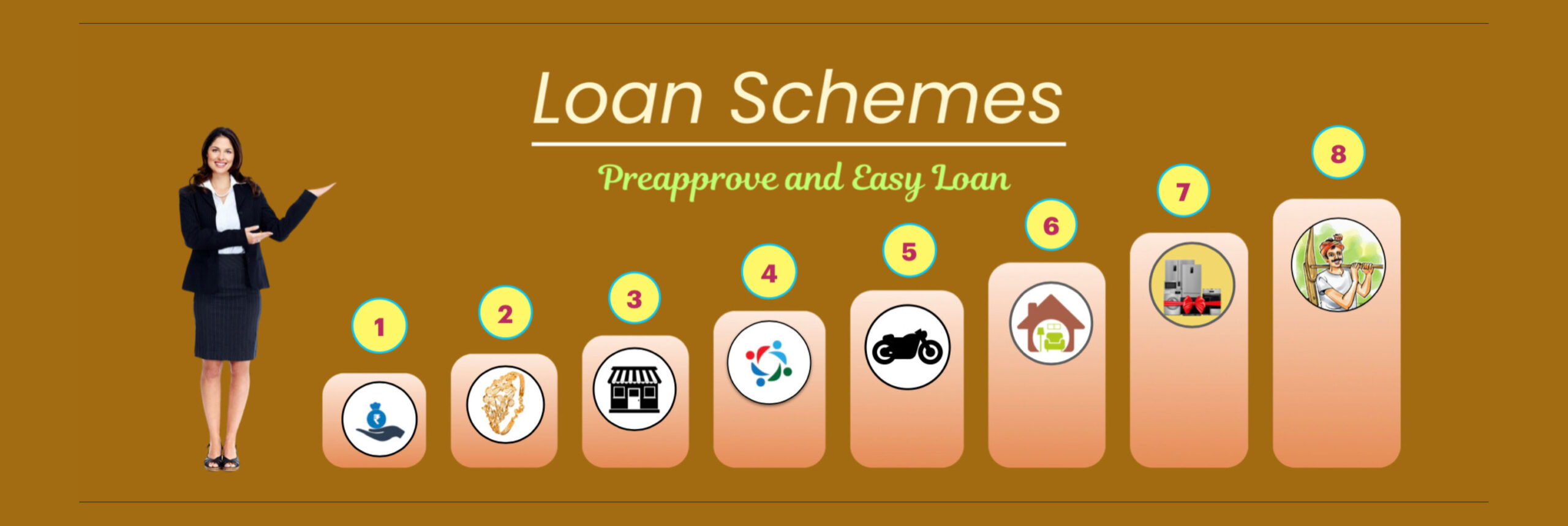

Loan Products

Loan Against Deposit

This is a simple loan scheme to the members of the society. Incase of urgent loan and advances required by the depositor, the society provide instant loan facilities, which are very easy, simple and at lower rate of interest. This type of loans normally approved within 3 working days. The society avails up to 70% on deposits.

Domestic Micro Loan

This type of loans is available for the domestic purposes only. The society preferring household goods to the members through this loan scheme to up-lift their livelihood. Upto Rs. 1,00,000.00 is covered under this scheme. The interest rate is very lower. The repayment maximum period is 12 months from the date of disbursement.

Personal Loan

This is a popular loan scheme for an individual. The salaried or professionals may take loans under this scheme for any purpose of personal development. Including the objects – medical needs, social & cultural and religious programme arrangement etc. This is a medium term loan. The repayment period is upto 36 months from the date of disbursement and maximum approval limit is 5 laces only.

Income Generation Loan

The purpose of this scheme’s is to increase self employment, self-help activities, encourage skill development, create business leadership and employment generation. The Society provides loan to it’s members towards income generation. The Society is trying to fulfill the financial needs of it’s members who are involved in small scale industries and self engagement as shopkeepers.

Lakhimi Auto Loan

The Society facilities Auto loan against the deposit of the applicant and guarantor up to 5 laces. Where includes two wheeler, three wheeler and four wheeler. It helps the members who are living in the rural or remote areas regarding proper communication and transportation for health and education.

Lakhimi Pariwar Kalyan Reen

This is a SHG loan scheme with a purpose of woman empowerment and skill development. The society organizes small groups among the women members. Where includes 5-11 women members. There are joint liabilities of entire group members. The loan limitation per head is Rs. 10,000.00 to Rs. 50,000.00 as on various productive estimate. The priority of the scheme will be for increasing agriculture, animal husbandry and textile productivity.

Lakhimi Krishi Vikash Reen

A loan scheme for the development of the farmers. The society provides complete agriculture based loan towards financially weak farmers to help increase their productivity and strengthen financial position. Whether it may be individuals or group farming. The interest rate of this scheme is very very low.

Member Durable Loan

This is a loan scheme for members of the society towards purchase of electronics goods on EMI basis. The applicant will get instant pre-approval of loan amount. The rate of interest ranges from 0 % to 11.99 % depending on type goods and tenure. Normally disbursed within 3 working days after the completion of documentation. The repayment period may be selected for 4 months to 24 months.